REVIEW

The market started the week at SPX 2105. After a rally to SPX 2118 on Monday the market had gap down openings three of the next four trading days. By late Friday the SPX had traded down to 2067, then ended the week at 2071. For the week the SPX/DOW were -1.55%, the NDX/NAZ were -0.80%, and the DJ World index lost 1.70%. Economic reports for the week were slightly biased to the negative again. On the uptick: personal income, the PCE, auto sales, ISM services, payrolls, plus the unemployment rate and trade deficit improved. On the downtick: personal spending, ISM manufacturing, construction spending, the ADP, factory orders, consumer credit, the WLEI, the monetary base, plus weekly jobless claims rose. Next week we get reports on Retail sales, the PPI and Consumer sentiment.

LONG TERM: bull market

We continue to count this six year Cycle wave [1] bull market unfolding in five Primary waves. Primary waves I and II occurred in 2011 and Primary wave III has been underway since then. While Primary I was a relatively simple two year advance of five Major waves, with only a subdividing Major wave 1. Primary III has already entered its fourth year, with an extensively subdivided Major wave 3 after a simple Major wave 1. Since we are expecting Primary III to continue into the year 2016, we are expecting Major wave 5 to subdivide as well.

We recently posted price and time targets for Primary III: SPX 2530-2630 by Q1/Q2 2016. As you will note in the weekly chart above, Primary III has spent most of its time trading around the mid-point of the rising channel from 2011. When it tops we would expect it to hit the upper trend line. Then after a serious correction for Primary IV, we would expect Primary V to take the market to all time new highs in 2017.

MEDIUM TERM: uptrend

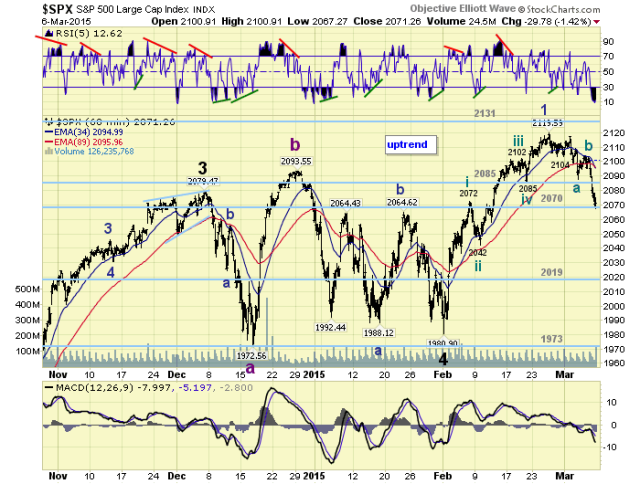

The uptrend that started the first day of February at SPX 1981 ran into some profit taking this week, as the market experienced its biggest decline since the uptrend began. Last weekend we had noted four potential short term counts into the SPX 2120 high. Two counts suggested the uptrend was subdividing into waves of a lesser degree. Two counts suggested a five wave advance, from SPX 1981, had completed and a pullback/correction would be next.

On Monday the market held SPX 2104 and rallied to nearly a new high at 2118. This kept all four counts alive. On Tuesday, however, the market dropped below SPX 2104 eliminating one of the subdividing counts. Then on Friday the market broke below SPX 2072 eliminating the other subdividing count. As a result we are left with a completed five wave pattern from SPX 1981 to 2120, and a pullback/correction underway. The five waves were previously noted: 2072-2042-2102-2085-2120.

With the five wave pattern we now have two possibilities. Either the SPX 2120 high completed the uptrend, or it is just Minor wave 1 of the uptrend. After reviewing the RSI on the weekly chart we arrived at the conclusion that the recent five wave advance is only Minor wave 1 of the uptrend. If it was the entire advance it would be the weakest impulsive wave, non B-wave, of the entire bull market. It looks similar to the beginning of Major 3 of Primary I, and the beginning of Minor 3 of Primary III. Both had small advances to start their uptrends, pulled back without ever reaching overbought, then resumed their uptrends. We will go with this count and discuss it in the section below. Medium term support is at the 2070 and 2019 pivots, with resistance at the 2085 and 2131 pivots.

SHORT TERM

As noted above we had a five wave advance from SPX 1981 to 2120: 2072-2042-2102-2085-2120. For now we are going to label this advance Minor wave 1, of a five Minor wave Intermediate one uptrend, with Minor 2 currently underway. Since the fifth wave of the advance was the weakest, wave structure support, for Minor 2, should arrive between SPX 2042 and 2072. Also there are three possible Fibonacci levels for the pullback: 38.2% (2067), 50% (2051) and 61.8% (2034). The SPX 2067 level is the actual low of the pullback thus far. Since the 2051 and 2067 levels fall in between the 2042-2072 range, we would expect one of these two to provide Minor 2 support.

In order to consider this advance a completed uptrend, this pullback/correction will have to drop below the OEW 2019 pivot. Until that occurs we will continue to expect this uptrend to resume once this pullback ends. Short term support is at SPX 2051 and the 2070 pivot, with resistance at the 2085 pivot and SPX 2120. Short term momentum ended the week extremely oversold.

FOREIGN MARKETS

The Asian markets were mixed on the week for a net loss of 0.1%.

European markets were also mixed for a net loss of 0.2%.

The Commodity equity group were mostly lower losing 1.5% on the week.

The DJ World index lost 1.7% on the week.

COMMODITIES

Bonds lost 1.4% on the week and remain in a downtrend.

Crude gained 0.2% on the week, but looks like it has entered a downtrend.

Gold dropped 4.1% on the week as its downtrend continues.

The USD is now uptrending for 10 months and gained 2.5% on the week.

NEXT WEEK

Tuesday: Wholesale inventories. Wednesday: the Budget deficit. Thursday: weekly Jobless claims, Retail sales, Export/Import prices and Business inventories. Friday: the PPI and Consumer sentiment. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

Thanks Tony.

My Best guess is a move down to 2050/60 on the cash for a swing low, and will be on the lookout for reversal structure of some kind.(not gonna try to short, as not as nimble as some others here).

Currently long global equity(Overweight Asia-Pac/Hong Kong/Brazil and the sunny side of Europe) and short T-Bonds. Don’t think stocks will get into their stride until P.M.’s and hard commods bottom out, which is very close imo, as global reflation is closer than most think. aimho.

Good health/ wealth and happiness to all.

S&P hourly (cash)

LikeLike

thx BG

LikeLike

LikeLike

Thanks PMS. Great charts! (Seems we share an Irish friend – Danny-boy!)

LikeLike

Gold is hanging-on to $1,166 for dear life, a break lower from here ($1,166 = the .786 retrace) and it’s good night. Double-bottom at $1,130 would be the bulls only hope, otherwise we’re heading into the $1,000’s with the next downside target being the 2008 high of $1,033

LikeLike

Looking for about HWB, 2077ish, then, I don’t know, hoping it’s up.

Have a great evening!

LikeLike

RCH goal 2043,5

Bearflag goal 2038

HS goal 2054,4

… we’ll see

ongoing RCH max pain 2082 goal 2073,3 (very short term)

Cu.

LikeLike

Ouuch! Thanks for letting us know sibyn.

LikeLike

C of an ABC corrective move up to about 2084?

LikeLike

Not sure I have the balls to short it there or not, but I’ll probably exit my longs from early this morning just beforehand and see how it plays out.

LikeLike

Hoping the last leg of this possible C wave up is starting or about to start, so time to short when it runs out of puff.

LikeLike

SPX mid day update

https://jobjas.wordpress.com/

LikeLike

Yes jobjas the intraday high so far meandered back to where one would reasonably expect a 4 to retrace on the SPX. The INDU on the other hand is a bit stronger and has made it back to within just 2 points of what would appear to be a 4 into 1 overlap on my system. Therefore intraday traders who believe this decline needs at least one more leg down to new lows have a well defined opportunity knowing they risk to only a few points above today’s INDU 17995.75 intraday high.

LikeLike

Would not suprise me if it closes gap 2099.

LikeLike

.618 of 2120-2067 = 2100

whether this is b of Minor 2 or start of Minor 3, hitting 2100 and turning would be ideal to whipsaw both bulls and bears!

LikeLike

Im going short here. I was expecting dow 18k and SP 2083. Close enough.

Will see

LikeLike

Agree take what you can quickly type of market and if unsure just stay put tricky market but gave a break upward so lets see if it gets there for sure no-mans land.

LikeLike

SPX is holding the 50 day ema. If it can close above resistance (2085-2087), those of us looking for a deeper pullback will probably be proven wrong. This market is like a monster in a horror film. You can shoot it, dismember it, decapitate it, set it on fire, and then flush the ashes down the toilet.

But then there is that late night knock on the door, and guess who is standing there.

LikeLike

so in the horror film how was it finally destroyed?

LikeLike

It was given a “Conviction Buy” rating by Goldman Sachs.

LikeLike

🙂

LikeLike

knock knock

who’s there?

(mumbled…) land shark.

LikeLike

My Goodness, trading is not supposed to be THAT emotional !!! It’s just numbers 🙂

I liked the Goldman Sachs part though. Too funny..lol..

LikeLike

Thanks to everyone weighing in on Prechter. My final thoughts–the man did popularize EW for the masses, certainly, and so my early positive experience with his newsletter and book have certainly been repeated many times over. The problem–Bob and his newsletter crew were on the absolute wrong side of gold as it made its run to a new ATH at $1900. Absolute on the wrong side the whole way. Bad news for anyone trying to follow their advice. They were also calling for a further Primary B wave and then another C wave down in indexes following the 2008 crash. Again, they completely missed the current bull run. Go back to the 1990-2000 decade, more to complain about. End of story. Be a perma-bear and wither away as one. Lao Tzu says in the Tao, “Stiff and unbending is the disciple of death.” Be too convinced of your powers, lose the humility…you’ll end up with your hand out for the alms.

LikeLike

Yes, that was bad- mentioned it here a few times. They had convinced themselves that a B-wave could go as high as it wanted to. Once you exceed 1.382, it generally should not be considered a B-wave. Worse still, they did not learn their lesson the failed gold call- they were still calling the SPX rally from 2009 a B-wave even as it exceeded 1.382. Perma-anything is bad news.

LikeLike

Hey Chris, thanks for your comment.

LikeLike