REVIEW

Summer holiday traders returned this week in the sell mode. Every new high, tuesday-thursday, was sold within the first hour and a half, or less, of trading. But the market managed to turn the tide on friday. For the week the SPX/DOW were +0.20%, the NDX/NAZ were +0.15%, and the DJ World index was +0.20%. On the economic front, positive and negative reports came in about even. On the uptick: ISM manufacturing/services, construction spending, factory orders, the unemployment rate, and the trade deficit improved. On the downtick: the ADP, payrolls, the WLEI, the monetary base, and weekly jobless claims rose. Next week we get a look at Consumer credit, Retail sales and Business inventories.

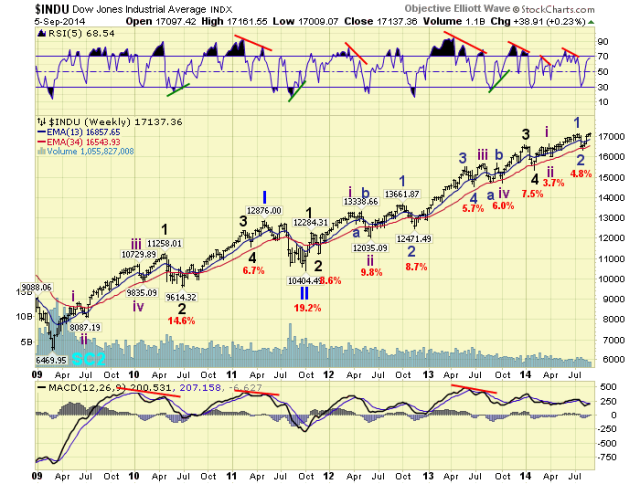

LONG TERM: bull market

For the past several months we have been tracking a subdividing Major wave 5 in the SPX. We had counted four Intermediate waves up into the recent early August low, and expected the next uptrend to conclude Intermediate wave v, Major 5 and Primary III. When the uptrend was confirmed we noticed two things about the correction that caught our attention. We posted these observations two weeks ago in the weekend update.

An exerpt: While we are maintaining our primary counts … We have noticed some deviations from what was expected during these past few months … The problems we are seeing are in the NAZ and the DOW. Since these two indices are key to our market observations, these deviations are worth noting.

You can read the entire posting, titled; “Potential Alternate Count” at the end of that weekend update: https://caldaro.wordpress.com/2014/08/23/weekend-update-462/.

This week Europe’s ECB announced their first QE program, naming it ABS. While the details were not released, we gathered from several sources that the program could be as large as $1.0 tn. This would be quite similar in size to the FED’s QE programs. As you know, the liquity of these programs has been the driving force that has taken the SPX/DOW to all time new highs. It is also a bit odd that the ECB is starting ABS, just when the FED is ending QE 3.

When we consider the recent patterns in the NAZ and DOW, and now the ECB’s QE. We have the ingredients for a potentially extending Primary wave III. The chart above displays the count we have been tracking for months, suggesting a Primary wave III high is near. The chart below is the count we offered two weeks ago, suggesting another extension for Primary wave III. Right now we give them equal weight.

The key to this inflection point is the wave pattern. Since both patterns start from a Major wave 4 low in February, and have risen five waves up since then. The key level to watch is the August low at SPX 1905. Should the market fall below that low, Primary IV is underway. Should the market remain above that low, especially during the next correction, Primary III is extending. Therefore, the risk of remaining fully invested at this point is about 5% on the downside.

MEDIUM TERM: uptrend

The current uptrend began at SPX 1905 in early August. Thus far the market has rallied to SPX 2011 on thursday, and ended the week at 2008. While the four week rally has had a steep rise, similar to the February uptrend, it has run into some resistance lately. As of thursday we had counted five waves up from that low: 1945-1928-2005-1991-2011. The first wave was simple, the third divided into five waves, and the fifth was a diagonal triangle. At the high we had negative divergences on all time frames.

The market then pulled back to SPX 1990 on friday, the second largest pullback of the uptrend. But surprisingly rallied all the way back to SPX 2008 by the close. We believe the five waves up ended an impulse pattern of some degree. There is room, however, for a slightly higher high to complete this pattern with a slightly different short term count. In either case we would expect the OEW 2019 pivot to limit any further upside before the largest pullback of this uptrend unfolds.

If SPX 2011 was the high we would expect a pullback to either the OEW 1973 pivot, or the 1956 pivot. The first is a 38.2% retracement, the second a 50.0%. When we reach those levels the market will then have to decide if Primary III is over, or is extending. A larger pullback, especially below that rising trend line from 2012, would suggest Primary IV is underway. Holding one of those two pivots would suggest Primary III is extending. Medium term support is at the 1973 and 1956 pivots, with resistance at the 2019 and 2070 pivots.

SHORT TERM

Short term support is at SPX 1990 and the 1973 pivot, with resistance at SPX 2011 and the 2019 pivot. Short term momentum ended the week overbought.

The short term wave pattern defined above is easily seem in the above chart. We labeled the recent high with a 5 to indicate that five waves had completed from SPX 1905. Since we are not completely sure what degree it was we will leave that labeling for now until the inflection point clears. Recent corrections, during Jan/Feb and July/Aug, have corrected about 50% of the previous uptrend. If they were a series of 1-2’s, as the alternate count suggests, then a 50% pullback of the recent SPX 1905-2011 rally would be quite normal. Another interesting juncture in this relentless bull market. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly higher for a net gain of 1.4%.

European markets were all higher for a gain of 2.8%.

The Commodity equity group were mostly higher gaining 1.7%.

The DJ World index is uptrending and gained 0.2%.

COMMODITIES

Bonds continue to uptrend but lost 0.6% on the week.

Crude has been quite volatile this week, remains in a downtrend and lost 2.7%.

Gold is still downtrending losing 1.6% on the week.

The USD uptrend continues and it gained 1.3% on the week.

NEXT WEEK

Monday: Consumer credit at 3pm. Tuesday: Senate testimony by FED governor Tarullo. Wednesday: Wholesale inventories. Thursday: weekly Jobless claims and the Budget deficit. Friday: Retail sales, Export/Import prices, Consumer sentiment, and Business inventories. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

All the major indexes are posed to go higher except high yield. Will high yield pull em down tomorrow or everything else pull pull high yield up. I am bearish but I am always bearish. Machines and smart money will be watching jnk tomorrow. $vix still has its footing, key.

LikeLike

I hate this market, it’s like an opium den.

LikeLike

Hi Tony and everyone,

I see a completed ABC down in IWM going back to last Wednesday, but the move back up on Friday into today also appears to be following an ABC pattern. Right now it seems to be starting c of c to the upside, which would be the last move up to suck in the last bulls before the breakdown happens for real. Anyhow, that’s what I see. Best wishes!

LikeLike

2-side … I like your thinking here and I certainly acknowledge the possible ‘b’ wave but I am going to offer another possibility. If the downward a-b-c completed at RUT 1160.02 was a minor 4, then minor 5 is now underway, possibly with minute i and ii already complete. If we are in minor 5, RUT may extend up to fill the open gap near 1187 and may stretch into the low 1190s to complete the inverse H&S target from the 1107 bottom. Completing minor 5 would take some time — maybe into September expiration.

As for the bigger picture, I can acknowledge that we are in a wave 5 uptrend of some degree — this uptrend is weaker than the previous two uptrends of 2014 which suggests that it is indeed a wave 5. However, we are fast approaching mid-term elections and the holiday season, both of which tend to bring bullishness to the equity markets. I don’t think there’s enough time to complete a primary correction between the top of this uptrend and mid-term elections but we’ll have to wait and see.

LikeLike

I think it’s also worth noting that the growth indexes are leading higher right now, the daily price changes in the indexes are small, and volatility is absent — it just doesn’t “feel” like we are on the verge of a significant correction.

LikeLike

Looks like we get our answer tomorrow.

LikeLike

It may take a while to clear up the bigger picture but for the short term, RUT moving above 1183.29 should confirm a wave 5 and a move below 1160.02 should confirm an ongoing correction. If the RUT stays in between, the fog remains thick.

LikeLike

hi radrian6. I tend to lean toward minor 4 in spx as well as rut. think there’s more than ample time to get a primary degree correction. imo

LikeLike

Hi Wild,

Primary II in the RUT was about 30% so I would assume the Primary IV correction would be at least half of that. If the correction gets started by September OpEx, it could bottom before the elections.

LikeLike

$nyse is getting hammered.

LikeLike

Let me say you, if SCOTS vote for independence, it will wreak havoc on people who are known to have following thinking;

“Why do it today when we can do it after a year” AND

“Why work if we can live on benefits”

Now, you know who I am referring to…

LikeLike

The Irish ?

LikeLike

Lee, you got it wrong, please I am talking of Germans!! LOLZ

LikeLike

Haha

thanks SHRIHAS

LikeLike

This is a little sensitive, but the internal 54/46 poll this morning is an internal SNP poll! They have been extremely reliable recently. It won’t take long for an independent polling company to produce similar results, with more selling/turmoil in the markets, IMO.

LikeLike

LikeLike

$vix regained its footing, my guess is the code will close the $vix out today at 12.94. Right on the razors edge.

LikeLike

will we have a correction?

LikeLike

never ask a bear if we will have a correction 🙂

LikeLike

If you rearrange the letters in the name Vladimir Vladimirovitj Putin, you get the word illuminati.

LikeLike