November 1 2019

It was an excellent week in the equity world this Fed week. Looking at US markets we see the SPX, Nasdaq, COMPQ, and Dow Jones 30 all breaking out of multiple 1,2 setups to new highs. Looking at Europe we see similar set ups (though not necessarily the same OEW count) in the German Dax, the Swiss SMI, and the French CAC.

As expected, the US Fed cut its lending rate an additional 0.25%.

SPX opened the week with a gap open to 3032. The SPX touched 3048 at 10AM Tuesday morning and was then rangebound between 3020 and 3048 until Thursday afternoon when a run up began from 3023. A 12 pt. gap up on Friday kicked off a nice final day of the week with Friday closing out at 3066.

SPX/DOW moved up 1.47%/1.44% while NDX/NAZ gained 1.64%/1.74%.

On the economic front, Consumer confidence was slightly down. Advance GDP was higher than expected at 1.9% vs. 1.6% expected. Non-farm employment was +128K vs. +90K expected.

LONG TERM: Early stages of breakout from consolidation

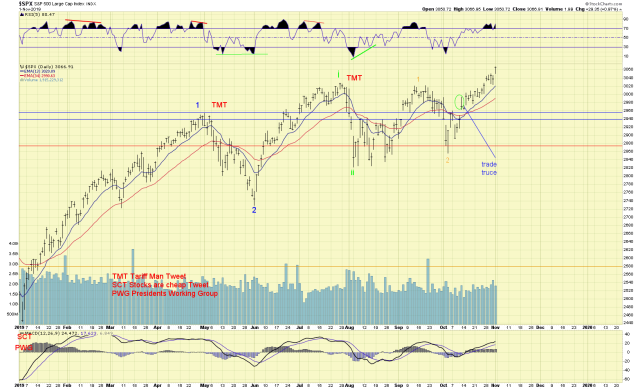

In the US, the long-term count remains unchanged with the Super Cycle SC2 low in March 2009. The Primary wave I high occurred in May 2015 and Primary wave II low in February 2016. Primary wave III has been underway ever since and the Major wave 1 high of Primary wave III occurred in October 2018. Our preferred long term count is posted on SPX, which reflects that Intermediate wave i of Major wave 3 is underway from the Major wave 2 low in December 2018 and continues to subdivide into Minor, Minute and now Micro waves. A breakout above the September micro 1 high at 3020 has occurred. We are bullish as long as the 2920 level provides support going forward.

MEDIUM TERM: Uptrend breakout in progress.

SPX appears to be breaking out of multiple 1,2 formations at this time. Consequently, there are no changes of our current preferred count. The new all-time highs appear to have confirmed the previous micro 2 low. This is a good start for an impulsive structure, ideally the previous 1 wave highs would provide support going forward. A move below 2893 would invalidate the current Micro wave 1 and Micro wave 2 count.

FOREIGN MARKETS

Asian markets (using AAXJ as a proxy) gained 1.15%.

European markets (using FEZ as a proxy) gained 1.08%.

The DJ World index gained 1.32%, and the NYSE gained 1.17%.

COMMODITIES

Bonds are in a downtrend but gained 0.5%

Crude oil is in a downtrend and lost 0.81%

Gold is in an uptrend and gained 0.41%

GBTC is in a downtrend but gained 8.6%.

The USD is in a downtrend and lost 0.46%.

Have a good week!

Pundit king is at it…

LikeLiked by 3 people

Agreed. From chaos to stability, halfway there maybe?

LikeLike

Always appreciate your sensitivity, Tor!

LikeLiked by 1 person

Just remember this one thing……and this is fact!! The stock market goes up alot more than it goes down. You now how we know this? Because if it weren’t true then the market would of been at zero a long time ago. 🙂

LikeLiked by 4 people

Thanks, pumper. That’s very sound strategy, will look into this.

LikeLiked by 2 people