Weekend Report

Provided by the OEW Group

October 26 2019

SPX opened the week up and rallied to reach 3007 by Monday’s close. Last weeks close was 2986. Tuesday gapped higher and rallied to 3015 by early afternoon, then declined to finish as an outside day down at 2995. Wednesday opened lower and made the low of the week at 2991 in the first half hour of trade, then rallied back for the rest of the day to finish at 3005. Thursday opened with a gap higher and reached 3016 in the first half hour, then reversed and chopped around in a 16 point range for the rest of day, before closing at 3010. Friday opened lower but quickly reversed and rallied to the high of the week at 3027 before noon, then consolidated for the rest of the day to finish the week at 3022.

SPX/DOW gained 1.22%/0.70% while NDX/NAZ gained 2.04%/1.90%.

On the economic front, Existing and New Home Sales declined while median prices increased. Durable Goods Orders declined for total and ex-transportation. EIA Crude Inventories declined. Consumer Sentiment (final reading) was up from prior month at a bullish 60.5%.

LONG TERM: Uptrend consolidating

In the US, the long-term count remains unchanged with the Super Cycle SC2 low in March 2009. The Primary wave I high occurred in May 2015 and Primary wave II low in February 2016. Primary wave III has been underway ever since and the Major wave 1 high of Primary wave III occurred in October 2018. Our preferred long term count is posted on SPX, which reflects that Intermediate wave i of Major wave 3 is underway from the Major wave 2 low in December 2018 and continues to subdivide into Minor, Minute and now Micro waves. We modified our long term status to identify that the uptrend is consolidating and that remains until Major wave 3 can clearly breakout of the overlapping wave structure. Our alternate count for a potential breakdown is posted on the DOW in the public chart list.

MEDIUM TERM: Uptrend

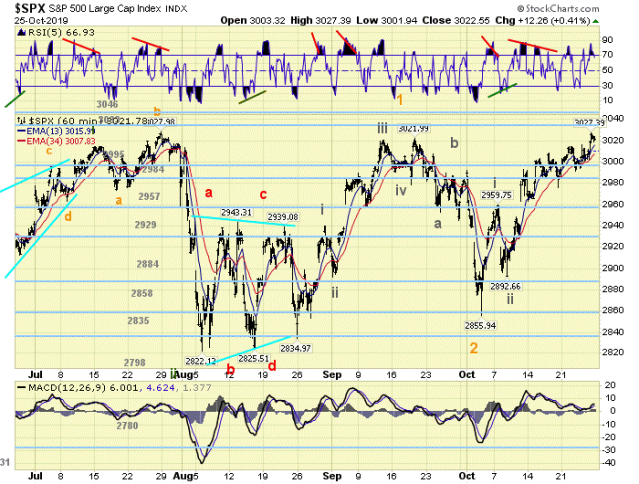

SPX continued the rally this week to reach 3027, just one point shy of the all-time, before pulling back to finish the week at 3022. The rally was sufficient to confirm a new uptrend and the medium term status has been updated accordingly. We now have NAZ, NDX and SPX in confirmed uptrends and we’re expecting DOW to follow in the coming days. Several other key indices have confirmed as well, such as DJW, NYA, TRAN and XLF. This suggests Micro wave 2 completed at the 2856 low early this month and Micro wave 3 has been ongoing ever since. Our nominal target for Micro wave 3 would be 1.618x Micro wave 1, which gives 3180. However, if the rally fails to exceed the 3056 pivot, which is right at Micro wave 3 equal Micro wave 1, then the consolidation pattern that’s been in play since last October will remain.

SHORT TERM

Not much has changed short term. We continue to count three waves up from the Micro wave 2 low as Nano wave i = 2960, Nano wave ii = 2893 and Nano wave iii in progress. Nano wave iii has now extended beyond the length of Nano wave i, which further suggests an impulsive pattern is underway. The next level to watch for a potential target is 3061, which is the 1.618x ratio. A retrace back to 2960 would warn that another subdivision may be in play, while below 2893 would invalidate the impulse.

Short term support is at the 2995 and 2984 pivots. Resistance is at the 3033 and 3046 pivots.

FOREIGN MARKETS

Asian markets (using AAXJ as a proxy) gained 1.48%.

European markets (using FEZ as a proxy) gained 0.44%.

The DJ World index gained 1.31%, and the NYSE gained 1.07%.

COMMODITIES

Bonds are in a downtrend and lost 0.29%

Crude oil is in a downtrend and gained 5.18%

Gold is in an uptrend and lost 0.75%

GBTC is in a downtrend and gained 4.75%.

The USD is in a downtrend and gained 0.61%.

CHARTS: https://stockcharts.com/public/1269446/tenpp

Have a good week!

Fiona, UGAZ continues to take the path you instructed… Nice job! Next time I will have patience.

LikeLiked by 2 people

It could strike you 24 target price soon! Nice double…

LikeLiked by 1 person

They have phil derangement syndrome!

LikeLiked by 1 person

Phil,

I am suggesting that you double your posts on this blog. Just because if makes Tom Fischer,

M Wags, Aahmichael, and Fiona so angry. My apologies if I missed any other angry people.

There are others on this blog that read your posts and are not angry!!

LikeLiked by 1 person

They have phil derangement syndrome!

LikeLiked by 1 person

Funny!

If I had followed Phil’s calls on Bonds and EXAS with a $100,000 account this year…I’d be left with nothing but tax losses for the next 20 years.

Now back to your regularly scheduled programming of “paper” trades.

🙂

LikeLiked by 1 person

Forget what phil does. He does his own thing. You have alot of good posts. Your last one about barrons was huge. Thank you

LikeLiked by 3 people

And if I would have bought EXAS at $119 when Fiona said it was going to $150 I would be down $30 a share or shorted GE at $7 when she said it was going to $4 and now it’s $10-1/2.

LikeLiked by 1 person