Weekend Report

Provided by the OEW Group

October 5 2019

SPX opened the week up and rallied most of the day Monday to close at 2977. Last weeks close was 2962. Tuesday had a gap up to reach the high of the week at 2993 within the first half hour of trade, but then sharply reversed lower, apparently based on the bad ISM report signalling a contraction in manufacturing. SPX then sold off the rest of the day Tuesday, gapped down on Wednesday and continued to decline until it found the low of the week at 2856 in the first hour on Thursday. From there, SPX rallied to reach 2911 by Thursday’s close. Friday opened with a gap higher and continued a strong rally all the way back to within Tuesday’s price range, before closing the week at 2952.

For the week, SPX/DOW lost 0.33%/0.93% while NDX/NAZ gained 0.94%/0.54%.

On the economic front, ISM Manufacturing and Services were both lower, although Services remains in expansion mode. Payrolls were higher as the unemployment rate made a 50 year low at 3.5%. Our Investor Sentiment indicator increased to 56.5% and is quite bullish as we read the data. The ECRI weekly growth indictor moved up for the third week in a row and is back above the zero line at +0.83%.

LONG TERM: Uptrend may be weakening

In the US, the long-term count remains unchanged with the Super Cycle SC2 low in March 2009. The Primary wave I high occurred in May 2015 and Primary wave II low in February 2016. Primary wave III has been underway ever since and the Major wave 1 high of Primary wave III occurred in October 2018. Our preferred long term count is posted on SPX, which reflects that Intermediate wave i of Major wave 3 is underway from the Major wave 2 low in December 2018 and continues to subdivide into Minor, Minute and now Micro waves. However, we maintain our cautious status that the uptrend may be weakening until Major wave 3 can clearly breakout of this overlapping structure. Consequently, we’re still tracking our alternate count on DOW in the public chart list.

MEDIUM TERM: Downtrend

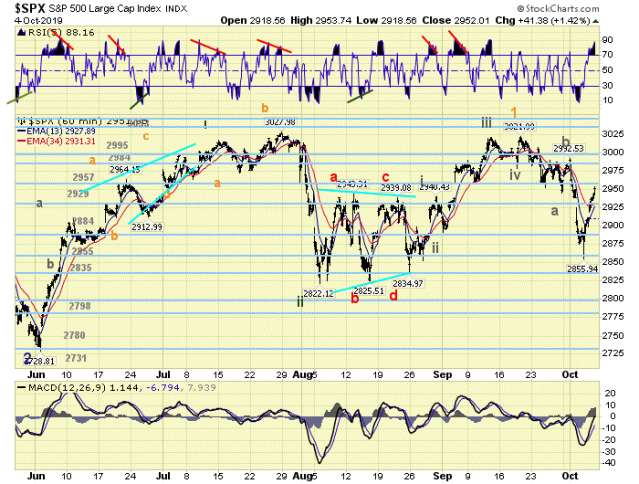

SPX extended the decline with a large outside reversal down on Tuesday (same as last week), followed by a gap below the critical 2940 level mentioned last week and reached a low of 2856 Thursday morning. A strong reversal for the remainder of the week retraced halfway back for the entire decline from the 3022 high. SPX finished the week at 2952, which is within the next pivot range and just below the medium term EMA’s which are providing resistance for the time being. This price action confirmed that a new downtrend is underway with the possibility of a completed pattern at the 2856 low. This also resolved the scale dilemma that we’ve been discussing for the last few weeks. As a result, we can now count five waves up from 2822 to 3022 with a small fifth wave, which suggests the entire uptrend is Micro wave 1 of Minute wave iii. Micro wave 2 has been underway since the September top and found support at our 2858 pivot range, with medium term subdivisions that suggest a completed zig zag pattern of three waves down. This represents a 5.5% decline, which would be typical for this wave scale. However, we need more price action to see if a new uptrend can take hold, or whether another retest of the low may be forthcoming. Medium term RSI got sufficiently oversold at the low, which is consistent with prior downtrend lows.

SHORT TERM

As mentioned in the previous section, we’ve rescaled the count to show Micro wave 1 as five Nano waves up from 2822 to 3022, which includes a subdivided leading diagonal for Nano wave i as part of that sequence. Using our short term techniques we can count seven small wave down from the 3022 top, which suggests a 5-1-1 zig zag pattern for Micro wave 2 so far. That gives Nano wave a = 2946, Nano wave b = 2993 and Nano wave c = 2856. We then have a 98 point rally off the low to the intraday high on Friday, which is by far the largest retrace since the downtrend began. Short term RSI ended the week extremely overbought, so a small wave pullback could come at any time. With all the volatility this week, SPX ended right back in the same support/resistance zone where it left off last week. As one of our members pointed out while discussing group sentiment, “nothing has changed”. So far, only the speculative short term waves have been affected.

Short term support is at the 2929 and 2884 pivots. Resistance is at the 2957 and 2984 pivots.

FOREIGN MARKETS

Asian markets (using AAXJ as a proxy) gained 0.83%.

European markets (using FEZ as a proxy) lost 1.49%.

The DJ World index lost 0.90%, and the NYSE lost 1.08%.

COMMODITIES

Bonds are in a downtrend and gained 1.17%

Crude oil is in a downtrend and lost 5.54%

Gold is in an uptrend and gained 0.43%

GBTC is in a downtrend and gained 3.89%.

The USD is in an uptrend and lost 0.22%.

CHARTS: https://stockcharts.com/public/1269446/tenpp

Have a good week!

are you the 1 % ?

LikeLiked by 6 people

Thank you OEW group.

LikeLike

SPX

BTC

LikeLiked by 3 people

hope all goes well for you christine

God Bless !

LikeLiked by 1 person

and thanks for the update OEW group !

LikeLiked by 1 person

https://pbs.twimg.com/media/EHRtg9zX0AMyiMA?format=jpg&name=900×900

pay no attention to the man behind the curtain

this is not QE ……

LOL

LikeLike

Paranoid Bull Retweeted

Lawrence Lepard

@LawrenceLepard

·

16h

5 months undone in 5 weeks. Not QE. Move along folks nothing to see here. source:

@chrismartenson

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

chart is above

LikeLike

LikeLike

dollar ………… still in free fall

gold ………….. still cant get out of its own way

LikeLiked by 1 person