Good Morning.

Hope all is well. A few notes before the Weekend Report.

I’ve added a like feature and a rating system to the comments. Hopefully this helps reduce the bickering. Feel free to vote on things you appreciate and don’t appreciate. It’ll also show me what is “valued” content and what is not. As for previous post limit rule that keeps getting brought up. I do not have the time to count posts and scold people when they pass their post limit. I’m looking into some plugins to potentially help with that. The site will be evolving and changing and more features will be added as I have the time. For those of you who are attempting to use my father as a weapon against me you will be immediately banned if it happens again. I will say this one more time. Having the comments open does nothing for me, them remaining open is only for you who comment here. Keep that in mind when picking fights with each other or me.

Be Kind and have a good week.

Thanks to the OEW Group for providing this weekend report!

Weekend Report – April 13, 2019

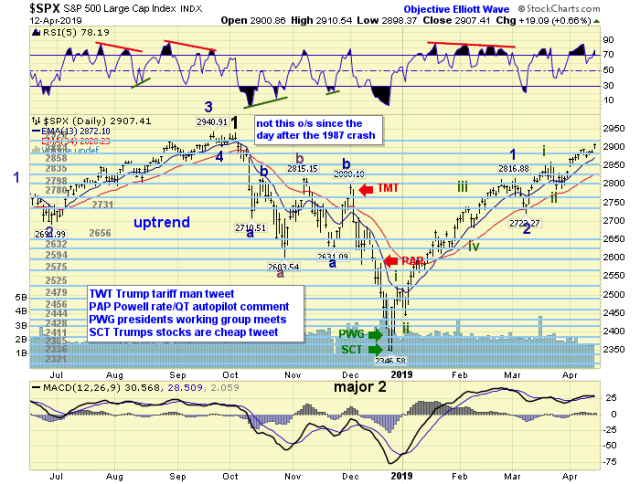

This week was largely a consolidation period with most of the indices making marginal new highs in choppy trade. After a quick move down to 2881 on Monday morning, the SPX rallied to 2896 in the afternoon. Tuesday saw a gap down and the weekly low made in the afternoon at 2873. Price traded in range of 20 points on Wednesday and Thursday. On Friday, the SPX gapped up and rose to 2911 on earnings and merger news. The SPX closed the week at 2906.

For the week, the SPX/Dow gained 0.3% and the NAS/NDX was up 0.6%.

On the economic front, we saw an uptick in the NFIB Small Business Optimism Index, CPI, PPI and Core PPI. There were negative reports for factory orders, JOLTS – job openings, and the University of Michigan Sentiment Index.

Next week’s report will highlight the Empire State Manufacturing report, industrial production, capacity utilization, retail sales, Fed’s Beige Book, and Leading Indicators.

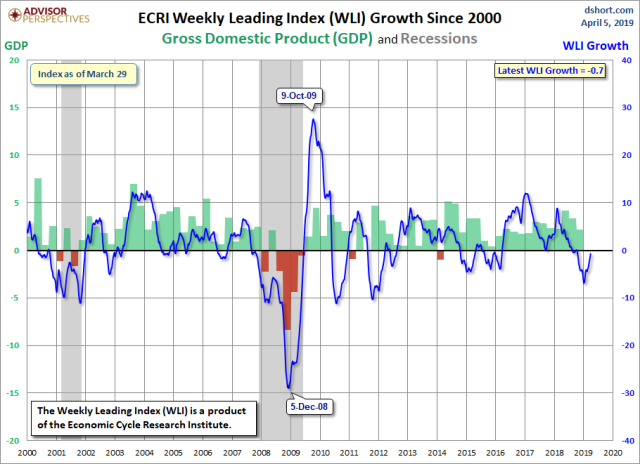

The ECRI Weekly Leading Index continues to improve to -0.7 (April 5th data).

LONG TERM: Uptrend

In the US, the long-term count remains unchanged with the Super Cycle SC2 low in March 2009. The Primary I high occurred in May 2015 and Primary II low in February 2016. Major wave 1 high occurred in October 2018 and Major wave 2 low in December 2018. Intermediate wave i of Major 3 is now underway.

MEDIUM TERM: Uptrend

We maintain our SPX wave count with the Minor 1 top at 2817 and Minor 2 bottom at 2722 with Minor 3 underway. As expected, Minor 3 is subdividing with Minute i at 2852 and Minute ii at 2785 with Minute iii underway. Minor 3 will extend higher to all time highs in the coming weeks.

SHORT TERM

We are counting the high at 2852 as Minute i and the low at 2785 as Minute ii. The rally off the Minute ii low also appears to be subdividing into Micro waves as shown on the 60-minute SPX chart with Micro 3 still underway.

Short term support is at 2900 and the pivots of 2884 and 2858. Resistance is at the 2929 and 2995 pivots. Negative divergences exist on daily SPX charts. SPX hourly was reset with drop on Tuesday, when RSI moved below 30.

FOREIGN MARKETS

Asian markets (using AAXJ as a proxy) were flat.

European markets (using FEZ as a proxy) were up 0.9%.

The DJ World index gained 0.4%, and the NYSE gained 0.3%.

COMMODITIES

Bonds are in an uptrend and were flat.

Crude oil remains in an uptrend and gained 0.8%.

Gold is in a downtrend and was flat.

Bitcoin is in an uptrend and gained 1.3%.

The USD is in a downtrend and lost 0.2%.

Retail sales +1.6 % in March. Great news for Bulls . The slow down in macro is temporary.

LikeLiked by 1 person

Bears obviously don’t like good news.

1 star = very poor:-)

LikeLike

Lol Elmer, the rating this is a waste of time because people aren’t giving 5 stars to well thought out/factual posts and 1 star to weak ones. They give 5 to someone who’s market view they agree with and 1 to someone they don’t, which just means we end up with 2s and 3s overall. Plus there are some people clearly voting 1 on everything for a laugh. And for a blog which supposedly has thousands of views, only 5-15 people are bothering to vote so it’s a statistically insignificant sample size. Total waste of time having a voting system as it’s just noise

LikeLiked by 5 people

Mcg, be careful of the Bridgwater guy. He comes up with his big theories while hes down smoking in his personal sub watching the sea animals. Lol. Happy Easter!

LikeLiked by 1 person

The man that you speak of (Ray Dalio) manages the largest global macro hedge-fund in the world. In 2005, Bridgewater became the world’s largest hedge fund. They currently manage $160 Billion.

https://en.wikipedia.org/wiki/Ray_Dalio

Dalio is worth $18 Billion.

He must be doing something right.

🙂

LikeLiked by 3 people

Hi Blue. Yep, i know who he is. He has done great. Meritocracy and all that. I just dont believe he knows the future. Nobody does. Sometimes Billionaires like to act like they do. Remember when mark cuban told everyone to get out of stocks if trump wins? Ya, ok mark. I always like to side with Buffett. Buy good companies when they are down and hold on. He could buy Ray out a few times over. Remember when Buffet bet all the hedge fund guys they couldnt beat the s&p? Well, you know who won. Lol.

I am a bull, i remain a bull, and i think what Tony Caldero did is absolutely amazing. He quantified the elliot wave, and elliot wave is bullish given a free, democratic, capitalistic society. Ray will be proven wrong.

Hope you all have a nice Easter Weekend!

LikeLiked by 2 people

I think with Buffett, what separates him from the other billionaire investors is his longevity.. and longevity is important for compounding returns. You can’t compare him directly to Dalio and say he’s worth more so he’s better because he’s 19 years older. As a general rule of thumb, you should be looking to double your money every decade if you’re matching the market’s long run returns. So when Dalio is Buffett’s age, his net worth might be a 4 fold increase on now which would put him in Buffett’s league.

Would also argue that since 2009 we don’t have free market capitalism. Central bank intervention has suppressed rates which has supported broken business models. So productivity growth is low and R&D investment is replaced by buying back stock. Not a good set up for long term earnings growth. Capitalism will

win out in the long run, but it could take a decade to get back to the peak once this turns.

You can’t put too much faith in the OEW count, have to do your own research. Look at what happened in 2016… it’s not impossible that it fails to project a major bear market in the next few years, particularly as it seems to be out of sync with the business cycle. The vast majority of economists have a recession coming in the next few years so I can’t see that being a wave 3 of 3 bullish event. They could all be wrong of course, but in the balance of probabilities it’s more likely than not

LikeLiked by 4 people

Cr. CBZ

LikeLike

LikeLike

LikeLike

And the San Francisco Bay Area is the 11th biggest economy in the World.

🙂

LikeLike

And it is a disgrace that there are used needles and human feces all over the streets and near playgrounds.

LikeLike

tech and con discretionary have been pulling the wagon, no longer health care

LikeLike