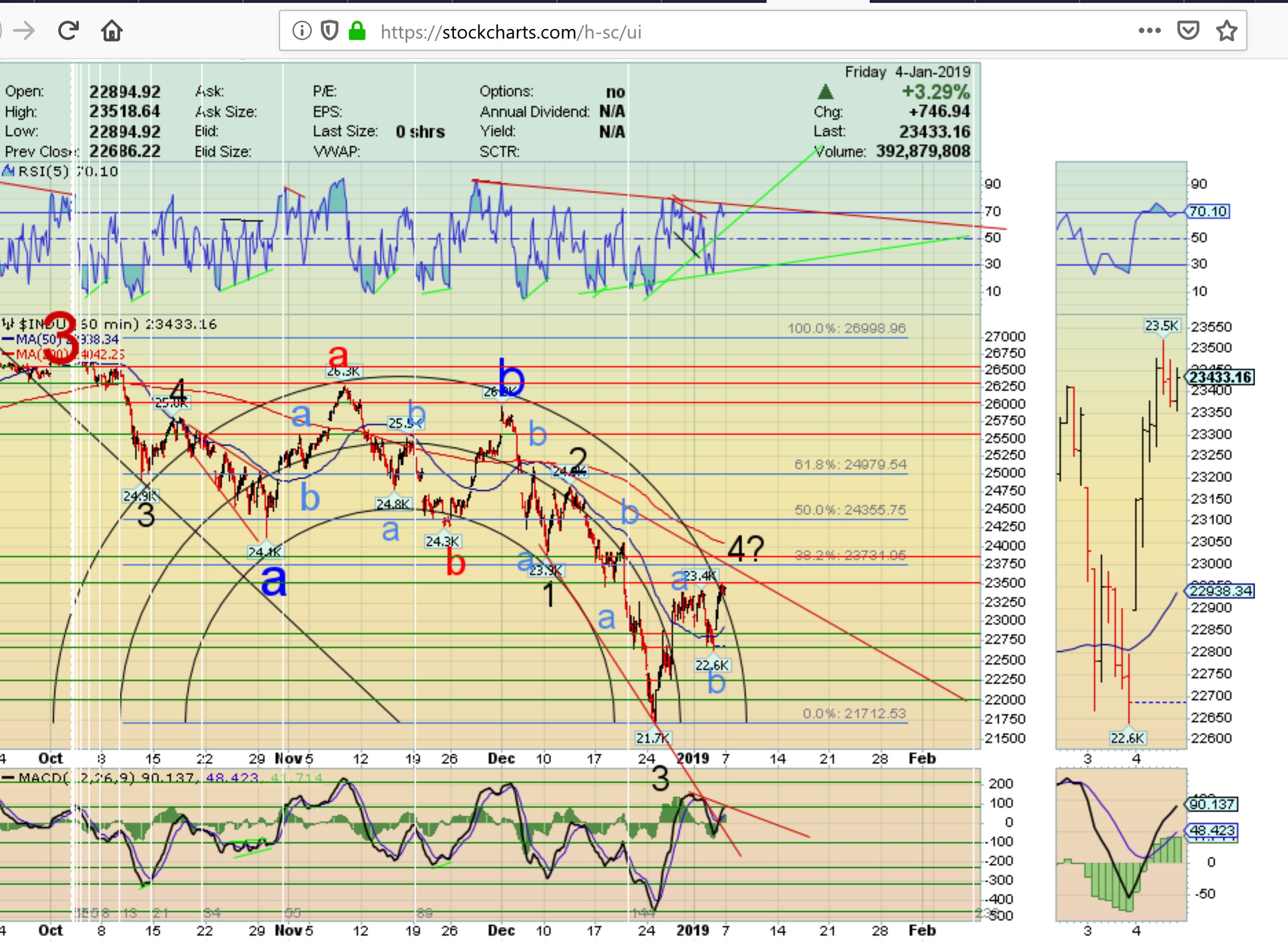

SHORT TERM: gap down opening then rebound, DOW +19

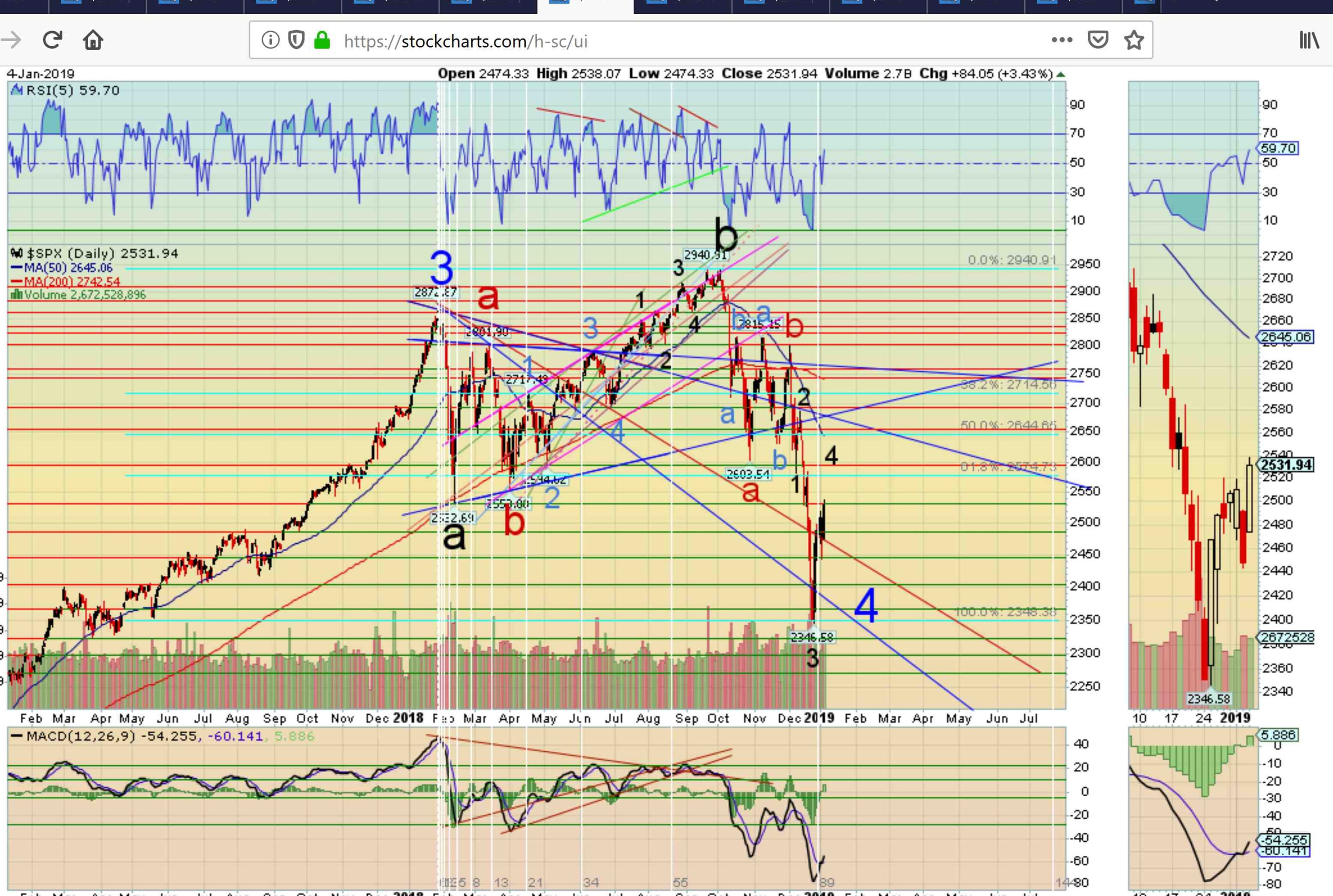

For the first three days of this holiday shortened week the Asian markets lost 0.9%, and the European markets gained 0.5%. The US market after doing two zigzags up from the SPX 2347 downtrend low, may have started the third zigzag at today’s SPX 2467 low. The previous zigzags were: [2367] 2414-2394-2468 and [2398] 2508-2473-2520. This third one could be: [2467] 2519-2495-xxxx. Had the first leg up of this potential zigzag exceeded SPX 2520 we would feel better that another one is underway.

A market maker in the making. Bernanke, Powell and Yellen get together on Friday morning for a round table discussion. Will Powell announce a QT freeze? Short term support remains at the 2479 and 2456 pivots, with resistance at the 2525 and 2575 pivots. Short term momentum ended the day around neutral. Best to your trading and Happy New Year!

MEDIUM TERM: downtrend

LONG TERM: downtrend probable

https://imgur.com/c2yA7xP

https://imgur.com/Hj63VaK

https://imgur.com/ZvEKtMk

https://imgur.com/6j7yLrz

LikeLike

http://tradingdiary.incrediblecharts.com/

Thanks Colin Twiggs

https://www.mcoscillator.com/learning_center/weekly_chart/santa_claus_report_card_is_in/

Thanks Tom McClellan

Thanks Tony.

LikeLike

I was just reading through the comments…totally great impressive stuff.

LikeLike

IMO…..the SPX, DJIA are in a Bear market….Top was 10/5.

If this date is correct, then the SPX market has much further to

fall, vs rally. We would have to see New Daily Price Highs to

change my view….that’s all…..

LikeLike

That’s useful. So if the market rises 16% to new highs then you’re back it. Brilliant investment strategy. Same concept worked great when you bought at 1560 in 2007 and broke to new highs. Bought after a double to only see a collapse of north of 50%. Love it. Good strategy.

LikeLike

Wow NYAD 10/1 positive.

LikeLike

Yep – Another 90% upside day followed by breadth thrust and breakaway momentum.

Beautiful sight 😀

LikeLike

It’s going to be a good year.

LikeLiked by 1 person

We stil need one wave down

LikeLiked by 1 person

Freddie, respectfully, the last breath thrust, as measured by the $nymo, which had a low in October and a high in November, produced 0 price reaction. In other words no decent rally. I think we’re in the same situation right now

LikeLiked by 1 person

Agree. I am long thru the wkend for the first time in a long time.

LikeLiked by 1 person

DOW/NDX hitting the bubble top??? =)

LikeLike

Just a bit higher into resistance….

LikeLike

Very nice and different perspective. Thanks for sharing

LikeLike

Thanks, SPX daily =)

LikeLike

No change in my view. Despite the setup at the close yesterday, the market had other ideas and made a run to the 20dma, which is normal and standard operating procedure for a DCB from outside the lower daily BB. Today was the equivalent of 11/7. The 7th day off the low. Yesterday’s setup at the close included a stop at 2473, which got hit overnight. I reshorted today at the 20dma, with a wide stop for now. IMO, today was another wonderful market gift to those who are bearish. It could easily rally one more day, but I don’t expect it to go longer than that.

LikeLike

Well, I agree with you. I shorted 2526 today. I have a few different counts, one of which we get to 2564 the other is 2575. Either way I then see dropping 300 -500 points from there. Best of luck and hope everyone has a nice weekend. I look forward to Tony’s weekend update.

LikeLike

you will have to wait few more weeks for the big drop. but we should get a drop toward the end of the next week of about 100-140 points

LikeLike

My ..Our man is Fred Am with you always look Up to Heaven. Prayers optional. You done the works ,You got your own solid convictions , Stick with the good as ,God helps those who help themselves.. Kudos Freddie

LikeLike

Whats you count now? 1 degree higher 4 wave? Thx

LikeLike

1 count is Working on c of the 4th wave up.

2347-2521 74 points A

2521-2444 76 points b

2444 – where equals a 74 points is 2518. Well we hit 2538. But today was a eurphia day so some over shoot is not in reasonable to trap bulls. Also if c equals 1.618 of a that’s 120 points and would target 2564. Plus the other 2 up waves have been 121 and 122 so 2564 makes this up wave from 2444 120 points as wellt

The second count is from 288 to 2347 was 453 points. A .50 retrace is 226 points.so 2347 plus 226 is 2573. That would be my b. Wave up with c down of another 453 or more points down.

So if it’s a wave 4 up completing at this level or 2564. I would expect another minimum 210 -300 points lower from that level. If a B wave another 400 points lower. So my risk is a lot up to 2573. Ultimate target is 2237 which is the .618 retrace From 1800-2943

1143 points .618 is 706

2943-706 equals 2237. Exact wave lengths are difficult at times.

LikeLike

Shorter version. If bullish then this is a wave 4 up to around 2564 with 5 down 210-300 points.

Bearish count. This is a B wave up from 2943-2347 596 points. .38 retrace is 226 or 2573 over 2573 offers the .50 and .618. 2645 and 2715. Why my stop is at 2573

2518-2573 still offers lots of possibilities

LikeLike

Thanks for your timely input Michael.

LikeLike

Yes thanks indeed Michael

LikeLike

Me Too….Thanks for your analysis! Always value your work! Please keep it coming!

LikeLike

AAH whats you count now. 1 degree higher 4 wave? Thx

LikeLike

Great day for the diagnostic and life sciences sector ahead of next week’s JPM Conference in SF.

ILMN +$18.00

IDXX +$9.50

HSKA + $6.70

QDEL +$1.90

EXAS +$3.50

SRPT +$9.20

LikeLike

US dollar and bond yields will push higher, much higher than people expect. This should not happen til later in year. Rotational bull due to inflationary pressures and profit squeeze from higher wages and costs. We are entering the late innings. Many keep writing off both the dollar and bond yields but data suggests otherwise.

Tony’s 2575 target seems very likely and within next 4 trading cycle. It coincides with my intuitive observations.

LikeLike

Leaving the numbers dog and pony show aside today’s rally was impressive. It shouts of a market that wants to, in the short term, go higher. Monday the hope of a china deal will still be on the table. I stayed long thru the wkend and right now plan to be out on Monday at some hour. May change my stance once I see what the blessed ever intruding news is screaming to the algos. .

LikeLike

VW.You got it right.My China watcher told me that China’s MoF would be there for USA. Your market exploded because their RRR = Reserve Ratio Requirement was Reduced – 2 x in 1US day – after their & HongKong markets closed. All for one & All for USA . Read their lips. Next week China Markets will explode ! Giving US opening a big Heads Up .

Bears Beware they have a long way to go UP. To make up what the US Non Constitutional Tariff war did to their market . They have more muscle than the West can imagine.. Believe it They want the Global markets to ignite!

Their exports are going to resume by multiplies sooner of later.

By then their own population will again be rescued revived Thank the World for being their ” Faithful customers”

A Win Win situation for All. BTW they pray to GOD as well. T C knows this too.

Thanks for listening.

E&OE

LikeLike

ttsden – Agree, China stocks are cheap on any metric, and mkts do indeed look ready to explode to the upside.

LikeLike

Dems think they can decide what a National Emergency is…Trump will use military. It’s in his back pocket when the Dems refuse.

https://www.bloomberg.com/news/articles/2019-01-04/trump-says-he-can-declare-national-emergency-to-build-wall

LikeLike

Doesn’t matter.

Congress holds the purse strings.

LikeLike

Gone are the days of trading the market. Now we trade the algos’ reaction to the MSM fodder.

LikeLike