REVIEW

The week started with a positive Monday, sold off on Tuesday, then ended within one point of the SPX 1902 all time high. The SPX/DOW were +0.95%, the NDX/NAZ were +2.40%, and the DJ World was +0.90%. On the economic front positive reports outpaced the negative 5 to 1. On the uptick: existing/new home sales, leading indicators, the WLEI and the M1-multipler. On the downtick: weekly jobless claims rose. Next week, holiday shortened by Monday’s Memorial Day, we get the second estimate for Q1 GDP, Personal income/spending and the Chicago PMI.

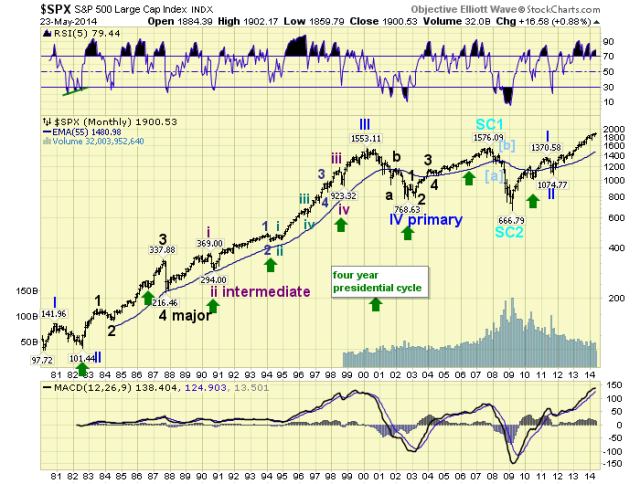

LONG TERM: bull market

The Cycle wave [1] bull market continues to unfold as expected. Primary waves I and II completed in 2011, and Primary III has been underway since then. When Primary III concludes we should get a multi-month 15% to 20% correction for Primary IV. Then another uptrend(s) to new highs completing Primary wave V and the bull market.

The two year Primary wave I unfolded in five Major waves with a subdividing Major wave 1. Primary II then took five months to unfold and the market lost 22% of its value. The current three year Primary wave III has also unfolded in five Major waves. But this time Major waves 3 and 5 subdivided. Major waves 1 and 2 completed in late-2011, and Major waves 3 and 4 completed in early-2014. Major wave 5 has been underway since that early-February low.

There is also a long term cycle low due this year: the four year Presidential cycle. Every four years this cycle low marks the low market price for the year. In recent cycles the month of July has marked the low, i.e. 2006 and 2010. Historically, however, July and October have had equal weight in marking the cycle low. Recent October lows occurred in 1998 and 2002. This year we may see a July high in price, and then an October cycle low.

MEDIUM TERM: uptrend

While many have been tracking a large potential diagonal in the SPX/DOW indices, and expecting a big decline. The count in the NDX/NAZ indices has suggested they are not done with Primary III just yet. We detailed our analysis on these two indices in last weekend’s update. This weekend we detail two potential patterns unfolding in the SPX/DOW. And, both generally point higher into the July/August summer months.

In each case we continue to count the February low as the end of Major wave 4 of Primary III. Since that low Major wave 5 has been underway. What has followed was an uptrend into early-April, a small downtrend into mid-April, and now another uptrend. Since both uptrends have been quite choppy, there are actually two ways of counting them.

The first count, which is much more bullish than the second, suggests an Int. wave one to SPX 1884, followed by an irregular zigzag to 1814 to end the correction. After the mid-April low we have a nesting pattern of 1-2-i-ii with wave iii underway now.

Here we count the entire Feb-Apr uptrend as an a-b-c Int. wave a, followed by an Int. wave b correction into mid-April. The current uptrend is also counted as a series of threes, which is typical of an ongoing a-b-c-d-e diagonal triangle. Notice the contracting trend lines that are forming. As noted above, regardless of the outcome both counts suggest higher highs for this uptrend. This will be followed by a correction, and then even higher highs, in another uptrend, to end Primary wave III.

Should the count posted on the SPX be the correct one, we should expect a Primary III high around SPX 2070. Should the count posted on the DOW be correct, the SPX should top around 1970 for Primary III. Medium term support is at the 1869 and 1841 pivots, with resistance at the 1901 and 1929 pivots.

SHORT TERM

Short term support is at SPX 1891 and the 1869 pivot, with resistance at the 1901 and 1929 pivots. Short term momentum ended the week quite overbought with a negative divergence. The short term OEW charts remain positive with the reversal level now SPX 1896.

Since we posted the hourly chart in the previous section we post the daily chart above. The NDX ended the week only 1.7% below its previous uptrend high. However, the NAZ is still 4.4% below its high and 5.6% below our projected NAZ 4420 uptrend target. Even if the NAZ outpaces the SPX two to one, in percentage terms, to reach its uptrend high. The SPX still needs to rise between 2.2% and 2.8% from Friday’s 1901 close. This projects a range of SPX 1943 to 1954 before the current uptrend ends. The next OEW pivot after 1929 is 1956.

If the SPX does top around the 1956 pivot, then the count posted on the DOW hourly chart is still in play, as the next correction would almost assuredly overlap the previous uptrend high at 1897. If the NDX/NAZ start surging, then the count posted on the SPX charts remains in play. It looks like we will reach an inflection point in the month of June. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly higher for a net gain of 0.8%.

The European markets were also mostly higher for a net gain of 1.5%.

The Commodity equity group were mixed for a net gain of 1.3%.

The DJ World index is still uptrending and gained 0.9% on the week.

COMMODITIES

Bonds continued their uptrend, but ended the week flat.

Crude (+2.2%) may be uptrending again as it continues its roller coaster ride above $90.

Gold (unch.) is still struggling to start a new uptrend. We think it will happen soon.

The USD looks like it has bottomed gaining 0.4% on the week.

NEXT WEEK

Tuesday: Durable goods at 8:30, Case-Shiller and the FHFA housing index at 9am, then Consumer confidence at 10am. Thursday: Q1 GDP (est. -0.5%) and weekly Jobless claims at 8:30, then Pending home sales at 10am. Friday: Personal income/spending and PCE prices at 8:30, the Chicago PMI at 9:45, then Consumer sentiment at 9:55. The FED has nothing scheduled for the week. Best to your weekend and week!

Thanks Tony …. My thoughts: http://balancetrading.blogspot.com/

LikeLike

Thanks for your thoughts , Tony!

LikeLike

happy memorial day CB

LikeLike

Thanks Tony! Have a great evening everyone!

LikeLike

Unless the index futures sell off overnight, I would expect a gap-up opening and upside continuation on Tuesday. For SPX, the low VIX is much less bothersome than its proximity to the weekly upper Bollinger Band. Closes above the weekly upper BB are rare and consecutive closes are even more so. Once SPX hits 1910 or so, expect the upside momentum to grind a bit or consolidate.

RUT broke higher towards the end of last week and set up a run to key resistance at 1138-40. I expect a pullback from there but if buyers come in aggressively and RUT makes a higher low, it should break above 1140 then run up quickly to the next key resistance at 1158-63. RUT will likely stall at that point and maybe drop back to test 1140 support. Keep in mind that the RUT daily upper BB is near 1137 — in a strong trend, it can close above the upper BB for three consecutive days before backing off. Key support for RUT remains near 1093.

Currently, the RVX (RUT volatility index) is at 17.69 which is high compared to the VIX. RUT was beaten down much more than SPX so the higher volatility index is understandable — there has been more hedging in the RUT. If the rally continues, keep an eye on RVX — if/when it reaches key support near 15, RUT is likely to stall and possibly reverse.

Bottom line … the near term appears bullish unless sellers come back into the growth indexes and push them back down.

LikeLike

Let’s pray for the RUT to regain it’s old relative strength to the SPX and cut it’s way through resistance points like a knife through hot butter, with the RVX crashing below 15.

LikeLike

We’re well into this bull market and the relative strength of the growth indexes is lagging. RUT may not regain its dominance during the final stages of this bull.

LikeLike

I am providing links to a charts of RUT/SPX and NASDAQ/SPX (RS charts) that show some short-term base building by these entities, with the 2nd one showing a longer base than the first.

http://stockcharts.com/freecharts/gallery.html?%24RUT%3A%24SPX

http://stockcharts.com/freecharts/gallery.html?s=%24COMPQ%3A%24SPX

LikeLike

Interesting to read about Putin and his plans for the Lunar-Project expected to peak around 2040 @rt-news. He is probably hitting it With funding from nat gas sale to China. This is not what you would expect from a country With a broken back, and just easy glance at the Debth to GDP figures tells us all that the Russian Bears are now more lean and mean than ever before. Sure, commodities just cant get any cheaper for a prolonged time, and I think that Putin is counting on just that..This is constructive plans and not destructive. Also Exxon and others nailed important deals in a recent oil-Convention in Russia, so this boycott cant be more than skin deep…The recent Development in Ukraine is also on a positive note. Well, amrket has been trough a Sovereign debth crisis (light) and a mini Cold war episode in a very short time and market is still standing, impressive. Good Luck to all for the coming week.

LikeLike

the total control roadmap for tuesday:

http://standardpoor.wordpress.com

LikeLike

Good freaking LORD! http://wavegenius.com/april-18-webinar-charts-results/

LikeLike

If you are so good, why do you come here. Ask yourself in the mirror 😉

LikeLike

You may wish to better, understand thy self…..

OEW, is another view. Or, opinion. As for

Tony C. He might enjoy more students ,oif OEW.

Me, I can’t help anyone here, no strong skill set.

At the moment, looking forward to a rad trip next

week. Knowing the smart investor, has been in

“protect financial agains mode, of the last 2-3 years.

Bud…

LikeLike

Pingback: Considerazioni sui mercati - Pagina 65 - I Forum di Investireoggi

Thanks Tony, I like the update to the DOW count, series of 3’s toward 1929 (1921/22) SPX pivot IMO. Nothing to be too bullish about, despite what most think, after ~ 6 months, the DOW is up only 30 points this YEAR? Day traders market.

More importantly- enjoy your Holiday

http://t.co/5SMO7ap91h

LikeLike

day traders market

happy holiday

LikeLike

Just FYI. This is free one month membership..Anything that is free is always welcome..In case if anyone of you want to join for a month…

https://www.technicalindicatorindex.com/

On the right side, just after NEW TO SITE

LikeLike

Good Luck

LikeLike

Hi Tony,

I know the Primary V of this 2009-20xx bull market is still far away..

I can’t wait to ask you, is what happened last 2003-2007 bull market? Why was Primary V so short and looks like it did not finish Elliot Wave rule/counts to hit 2007 peak.

Everyone’s analysis and comments are welcome 🙂

LikeLike

MS

If you mean the 2002-2007 PRI V bull market.

It actually was much longer than PRI I 1974-1976.

LikeLike

Hi Tony,

Oh, OK, got it.! 🙂

Got a followup question, still reg. 2002-2007 bull. PRI III was kinda short and weak. Was that valid under EW rules? and is that uncommon to happen? Still learning how to differentiate things:)

***Wave 3: Wave three is usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, wave five is the largest).

LikeLike

Only rule: wave three can not be the shortest.

LikeLike